Syed Shayan Real Estate Archive

From Real Estate History

On October 26, 1933, the US New Deal introduced transformative housing reforms during the Great Depression. The Home Owners' Loan Corporation (HOLC) and Federal Housing Administration (FHA) were established to prevent foreclosures, stabilize property values, and introduce long-term amortized mortgages. These initiatives revolutionized home financing by creating government-backed mortgage insurance, standardizing lending practices, and making homeownership accessible to millions. The reforms established federal oversight in housing markets, shifted risk from local banks, and laid the foundation for modern mortgage systems that would fuel post-war suburban expansion and shape American housing policy for decades.

▪ Reference(s):

26 اکتوبر 1933 کو، امریکی نیو ڈیل نے عظیم کساد بازاری کے دوران تبدیلی لانے والی ہاؤسنگ اصلاحات متعارف کروائیں۔ ہوم اوونرز لون کارپوریشن (HOLC) اور فیڈرل ہاؤسنگ ایڈمنسٹریشن (FHA) قائم کیے گئے تاکہ فورکلوژرز کو روکا جا سکے، پراپرٹی ویلیو کو مستحکم کیا جا سکے، اور طویل مدتی امورٹائزڈ رہن متعارف کروائے جا سکیں۔ ان اقدامات نے حکومتی حمایت یافتہ رہن انشورنس بنا کر، قرض دینے کے طریقوں کو معیاری بنا کر، اور لاکھوں لوگوں کے لیے گھر کی ملکیت کو قابل رسائی بنا کر ہوم فنانسنگ میں انقلاب برپا کیا۔

On October 26, 2005, the US housing bubble reached its zenith, marking the peak of unsustainable price growth that would soon trigger the global financial crisis. Property values had soared to unprecedented levels driven by speculative investments, subprime lending practices, and financial innovations that masked underlying risks. The market showed clear signs of overheating with inflated valuations, excessive leverage, and deteriorating lending standards. This peak represented the culmination of years of irresponsible lending and speculative mania that would soon unravel, leading to massive foreclosures, bank failures, and the most severe economic downturn since the Great Depression.

▪ Reference(s):

26 اکتوبر 2005 کو، امریکی ہاؤسنگ بلب اپنے عروج پر پہنچا، جو غیر پائیدار قیمتوں کی نمو کے عروج کی نشاندہی کرتا ہے جو جلد ہی عالمی مالیاتی بحران کو متحرک کرے گا۔ پراپرٹی ویلیو قیاس آرائی کی سرمایہ کاری، سب پرائم قرضے دینے کے طریقوں، اور مالیاتی اختراعات کی وجہ سے غیر معمولی سطحوں تک پہنچ گئی تھی جو بنیادی خطرات کو چھپا رہی تھیں۔

On October 26, 2012, the Federal Reserve's quantitative easing programs significantly accelerated the US real estate recovery from the financial crisis. By purchasing mortgage-backed securities and keeping interest rates at historic lows, the Fed injected substantial liquidity into housing markets, making mortgages more affordable and stimulating property demand. These unprecedented monetary interventions helped stabilize falling home prices, reduced foreclosure rates, and restored confidence in real estate markets. The programs demonstrated the powerful role central banks could play in supporting property markets during economic crises and established new precedents for monetary policy interventions in housing sectors.

▪ Reference(s):

26 اکتوبر 2012 کو، فیڈرل ریزرو کے کوانٹیٹیو ایزنگ پروگرامز نے مالیاتی بحران سے امریکی رئیل اسٹیٹ کی بحالی کو نمایاں طور پر تیز کیا۔ مارگیج بیکڈ سیکیورٹیز خریدنے اور سود کی شرحیں تاریخی حد تک کم رکھنے کے ذریعے، فیڈ نے ہاؤسنگ مارکیٹس میں کافی لیکویڈیٹی انجیکٹ کی، جس سے رہن زیادہ سستی ہو گئی اور پراپرٹی کی مانگ میں اضافہ ہوا۔

On October 26, 2018, blockchain technology began transforming real estate transactions through pilot programs testing property tokenization and smart contracts. This innovation promised to revolutionize property ownership transfers, title management, and transaction recording by creating immutable, transparent digital ledgers. Early adopters explored using blockchain for reducing fraud, streamlining closing processes, and enabling fractional property ownership through tokenization. While still in experimental stages, these initiatives demonstrated blockchain's potential to increase transaction security, reduce costs, and create new investment opportunities in real estate markets worldwide.

▪ Reference(s):

26 اکتوبر 2018 کو، بلاک چین ٹیکنالوجی نے پراپرٹی ٹوکنائزیشن اور سمارٹ کنٹریکٹس کی جانچ کے پائلٹ پروگراموں کے ذریعے رئیل اسٹیٹ لین دین کو تبدیل کرنا شروع کیا۔ اس اختراع نے ناقابل تغیر، شفاف ڈیجیٹل لیجرز بنا کر پراپرٹی کی ملکیت کی منتقلی، عنوان کے انتظام، اور لین دین کی ریکارڈنگ میں انقلاب برپا کرنے کا وعدہ کیا۔

On October 30, 2001, the Karachi Development Authority implemented Pakistan's first comprehensive high-rise building regulations, fundamentally transforming the city's vertical development patterns and establishing crucial safety standards for urban construction. The innovative regulatory framework established rigorous safety protocols for tall str...

Read More →

In 2021, the Federal Reserve introduced a series of strategic interventions aimed at stabilizing the U.S. real estate market amid growing concerns over housing affordability and financial volatility following the pandemic. Through a combination of monetary policy adjustments, including low interest rates, large-scale asset purchases, and liquidity ...

Read More →

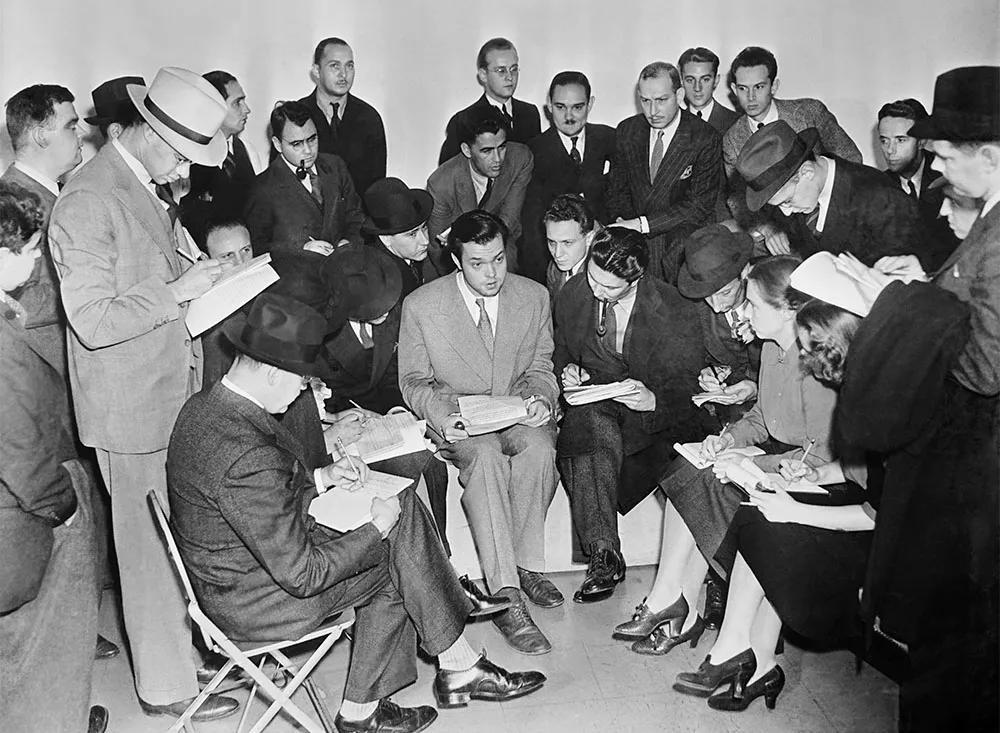

On October 30, 1938, Orson Welles' legendary radio broadcast of 'War of the Worlds' triggered unprecedented panic among millions of American listeners who genuinely believed Earth was under Martian invasion. In New Jersey areas specifically mentioned in the broadcast, property values experienced immediate temporary declines as terrified residents c...

Read More →

On October 18, 2020, the United Arab Emirates (UAE) introduced a set of comprehensive new regulations governing real estate brokerage practices across all seven emirates. The new framework required brokers and real estate agents to obtain proper licensing, follow standardized commission structures, and maintain full transparency in all property tra...

Read More →

On October 26, 2018, blockchain technology began transforming real estate transactions through pilot programs testing property tokenization and smart contracts. This innovation promised to revolutionize property ownership transfers, title management, and transaction recording by creating immutable, transparent digital ledgers. Early adopters explor...

Read More →

No comments yet. Be the first to comment!