Syed Shayan Real Estate Archive

From Real Estate History

On October 27, 1835, the first official institutional mortgage system emerged in the United States through 'Terminating Building Societies' (TBS), marking a revolutionary shift from informal property transactions to structured home financing. These societies pooled member resources to provide systematic mortgage lending, establishing foundational principles for modern banking. The TBS model introduced standardized loan terms, collective risk management, and formalized property ownership pathways that would evolve into contemporary mortgage institutions. This innovation democratized homeownership access and created the architectural framework for today's complex real estate financing systems that continue to shape property markets worldwide.

▪ Reference(s):

27 اکتوبر 1835 کو، پہلا باضابطہ انسٹیٹیوشنل مارگیج سسٹم 'Terminating Building Societies' (TBS) کے ذریعے امریکہ میں ابھرا، جو غیر رسمی پراپرٹی لین دین سے منظم ہوم فنانسنگ کی طرف ایک انقلابی تبدیلی کی نشاندہی کرتا ہے۔ ان سوسائٹیز نے رکن وسائل کو جمع کیا تاکہ منظم رہن قرضے دینے کی فراہمی کی جا سکے، جو جدید بینکنگ کے لیے بنیادی اصول قائم کرتی ہیں۔

On October 27, 1994, the Federal Reserve's aggressive interest rate hikes significantly pressured the US housing market, demonstrating the powerful connection between monetary policy and real estate activity. The series of rate increases throughout 1994 translated directly into higher mortgage rates, slowing home sales, reducing refinancing activity, and moderating price appreciation nationwide. This period became a classic case study in achieving a 'soft landing' for overheated housing markets through calibrated monetary tightening. The Fed's actions successfully cooled speculative excesses without triggering a severe downturn, establishing important precedents for using interest rates as tools to manage real estate cycles and prevent housing bubbles.

▪ Reference(s):

27 اکتوبر 1994 کو، فیڈرل ریزرو کے جارحانہ سود کی شرح میں اضافے نے امریکی ہاؤسنگ مارکیٹ پر نمایاں دباؤ ڈالا، جو مانیٹری پالیسی اور رئیل اسٹیٹ کی سرگرمی کے درمیان طاقتور کنکشن کا مظاہرہ کرتا ہے۔ 1994 کے دوران شرح میں اضافے کی سیریز براہ راست اعلی رہن کی شرحوں میں ترجمہ ہوئی، جس نے گھروں کی فروخت کو سست کیا، دوبارہ مالی اعانت کی سرگرمی کو کم کیا، اور قومی سطح پر قیمت کی قدر کو معتدل کیا۔

On October 27, 2019, Pakistan's Real Estate Regulatory Authority (RERA) became fully operational, marking a significant milestone in the country's property market regulation. The authority established comprehensive frameworks for project registration, developer accountability, and consumer protection in the real estate sector. RERA introduced mandatory project approvals, escrow account requirements, and standardized sale agreements to protect homebuyers from fraudulent practices and construction delays. This regulatory transformation aimed to enhance market transparency, boost investor confidence, and establish professional standards in Pakistan's rapidly growing property sector. The authority's operationalization represented a major step toward formalizing real estate transactions and creating a more secure environment for property investments nationwide.

▪ Reference(s):

27 اکتوبر 2019 کو، پاکستان کی رئیل اسٹیٹ ریگولیٹری اتھارٹی (RERA) مکمل طور پر آپریشنل ہوئی، جو ملک کی پراپرٹی مارکیٹ ریگولیشن میں ایک اہم سنگ میل کی نشاندہی کرتی ہے۔ اتھارٹی نے پراجیکٹ رجسٹریشن، ڈویلپر کی جوابدہی، اور رئیل اسٹیٹ سیکٹر میں صارف کے تحفظ کے لیے جامع فریم ورکس قائم کیے۔ RERA نے لازمی پراجیکٹ کی منظوری، اسکرو اکاؤنٹ کی ضروریات، اور معیاری سیل معاہدے متعارف کروائے تاکہ گھر خریداروں کو فراڈ کے طریقوں اور تعمیراتی تاخیر سے بچایا جا سکے۔

On October 27, 2020, Pakistan launched its first comprehensive smart city project in Islamabad, representing a major advancement in urban development and real estate innovation. The project integrated digital infrastructure, smart utilities, automated traffic management, and sustainable energy solutions to create a model for future urban planning. This initiative attracted significant foreign investment and established new standards for modern residential and commercial development in Pakistan. The smart city concept incorporated advanced technologies for efficient resource management, enhanced security systems, and improved quality of life for residents while setting benchmarks for sustainable urban development that could be replicated in other Pakistani cities.

▪ Reference(s):

27 اکتوبر 2020 کو، پاکستان نے اسلام آباد میں اپنا پہلا جامع سمارٹ سٹی پروجیکٹ لانچ کیا، جو شہری ترقی اور رئیل اسٹیٹ انوویشن میں ایک بڑی پیشرفت کی نمائندگی کرتا ہے۔ پراجیکٹ نے ڈیجیٹل انفراسٹرکچر، سمارٹ یوٹیلیٹیز، آٹومیٹڈ ٹریفک مینجمنٹ، اور پائیدار توانائی کے حل کو یکجا کیا تاکہ مستقبل کی شہری منصوبہ بندی کے لیے ایک ماڈل تخلیق کیا جا سکے۔

On October 27, 2022, Pakistan achieved a major milestone in property registration digitalization, significantly reducing processing times and enhancing transaction transparency. The comprehensive digital transformation included online property registration, electronic document verification, and blockchain-based title management systems. This modernization eliminated traditional bureaucratic hurdles, reduced opportunities for fraudulent practices, and created more efficient property transaction processes. The digital platform integrated various government databases, enabling real-time verification of property records and ownership details. This technological advancement represented a crucial step toward creating a more transparent, efficient, and secure real estate market in Pakistan while establishing foundations for future innovations in property technology.

▪ Reference(s):

27 اکتوبر 2022 کو، پاکستان نے پراپرٹی رجسٹریشن کی ڈیجیٹلائزیشن میں ایک اہم سنگ میل حاصل کیا، جس نے پروسیسنگ کے اوقات کو نمایاں طور پر کم کیا اور لین دین کی شفافیت کو بہتر بنایا۔ جامع ڈیجیٹل تبدیلی میں آن لائن پراپرٹی رجسٹریشن، الیکٹرانک دستاویز کی تصدیق، اور بلاک چین پر مبنی عنوان کے انتظام کے نظام شامل تھے۔

On October 27, 1835, the first official institutional mortgage system emerged in the United States through 'Terminating Building Societies' (TBS), marking a revolutionary shift from informal property transactions to structured home financing. These societies pooled member resources to provide systematic mortgage lending, establishing foundational p...

Read More →

On October 27, 1994, the Federal Reserve's aggressive interest rate hikes significantly pressured the US housing market, demonstrating the powerful connection between monetary policy and real estate activity. The series of rate increases throughout 1994 translated directly into higher mortgage rates, slowing home sales, reducing refinancing activit...

Read More →

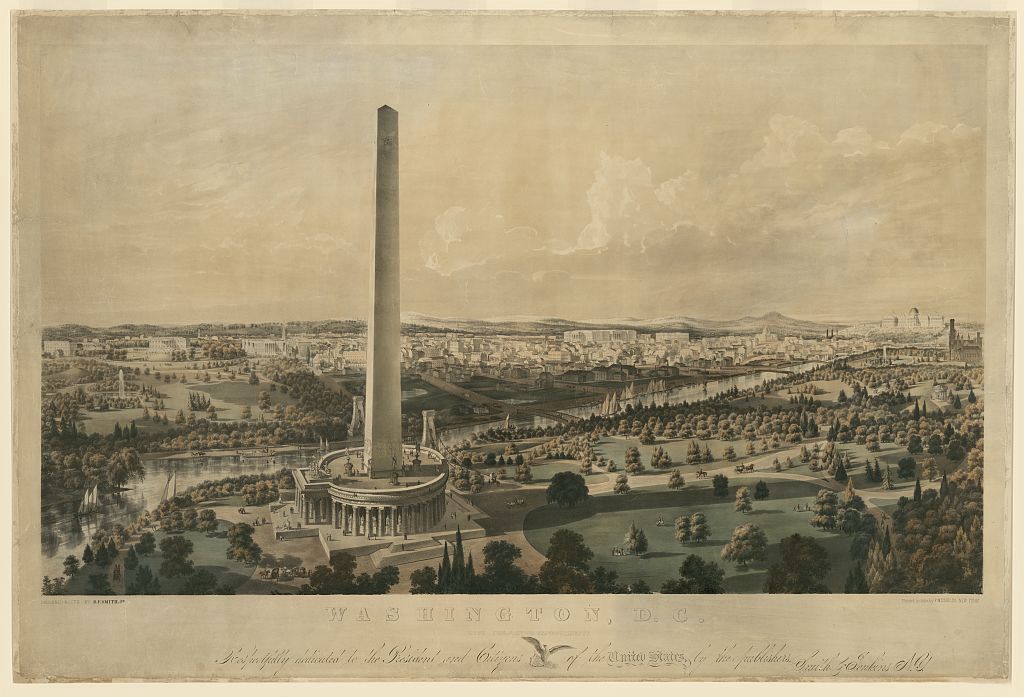

On October 9, 1888, the Washington Monument in Washington D.C. was officially opened to the public. Standing 555 feet tall, it was the tallest man-made structure in the world until the completion of the Eiffel Tower in 1889. Its construction, delayed for decades due to funding issues and the American Civil War, became a lasting symbol of civic visi...

Read More →

On November 2, 2015, world leaders and climate experts gathered in Paris to finalize the framework for the COP21 Climate Agreement, a landmark initiative aimed at limiting global temperature rise below 2°C. The conference represented a pivotal moment in global environmental policy, bringing together 196 nations to commit to emission reduction targ...

Read More →

In 2021, the Federal Reserve introduced a series of strategic interventions aimed at stabilizing the U.S. real estate market amid growing concerns over housing affordability and financial volatility following the pandemic. Through a combination of monetary policy adjustments, including low interest rates, large-scale asset purchases, and liquidity ...

Read More →

No comments yet. Be the first to comment!